Does it seem like your wireless bill keeps creeping up each year?

You know how it goes: you think you're getting the deal you saw on TV - "Get four lines for just $120 a month!"

Then the bill comes, and it's closer to $140 than $120. A couple of years go by, and suddenly, you're paying almost $150 per month...that great deal doesn't seem quite so sweet now.

You're not imagining things. According to the consumer tax and spending think tank Tax Foundation, average cell phone service fees and taxes have reached 18.6%.

This means that wireless customers are paying an average of $225 per year above and beyond the actual price of their mobile service. This number also represents a 4.5% increase in these extra fees over the past decade.

Percentages by state

In this guide, I'll explain what each hidden wireless fee and tax signifies, how to understand the terminology on your cell phone bill, plus tell you how to save money on your monthly cell phone expenses.

And there's more: I'll also show you which states have the highest mobile fees and taxes and which carrier offers the fairest pricing model.

By now, you've no doubt figured out that because of the vast differences in fees among localities, residents of some states are better off than others in terms of all of these extra cell phone bill charges. What are the best and worst places to live if you want to keep these fees to a minimum? Washington state has the highest rate of extra wireless charges, at 25.42%. Oregon is the best state to live in if you want low cell phone fees - their rate stands at just under 9%.

Where does your state stand? Check it out on our map of the states' wireless fee and tax rates:

Top 5 least expensive states

Here are the top five states with the lowest cell phone taxes in America.

| State | 2016 Combined Federal/State/Local Rate |

|---|---|

| Oregon | 8.48% |

| Nevada | 8.73% |

| Idaho | 8.90% |

| Montana | 12.85% |

| Delaware | 12.98% |

Top 5 most expensive states

These are the states with the highest cell phone taxes in the country.

| State | 2016 Combined Federal/State/Local Rate |

|---|---|

| Washington | 25.42% |

| Nebraska | 25.31% |

| New York | 24.68% |

| Illinois | 24.48% |

| Pennsylvania | 22.34% |

Do you live in one of these states? Short of moving, there are a number of different ways you can cut your cell phone bill to save money.

Fees vs taxes

First things first: you no doubt want to know just where all of that extra money that's fleeing your wallet is going. It depends on where you live - as I'll show you later on, fees and taxes vary from state to state.

Some states, like New York, charge sales tax on services. Others charge local taxes and fees. You may see a long list of fees on your bill, or you may only see a couple.

While a few of these charges are federal, state, or locally mandated, some are more ambiguous, leaving a lot of room to pick consumers' pockets.

Here's a good example of such a fee: the Police and Fire Protection Fee in Wisconsin is billed as such on every Wisconsin wireless customer's cell phone bill.

Funding police and fire services is a noble cause, right? Well, yes, if that's where the money was guaranteed to end up. Instead, this fee is deposited into a fund by the same name and then redirected into a general fund which is distributed to local governments to fund a variety of municipal services. How the money is spent is up to the local governments, which means it may not all be going to police and fire.

You can see how this might seem a bit misleading, yet states essentially have carte blanche to tack whatever charges they see fit onto your wireless bill. When you factor in the dizzying number of local and state taxes throughout the country, it's easy to see why all of these extra wireless fees are confusing.

Phone bill terms

Next up, let's take a look at the language used on your wireless bill and how to tell exactly what you're being charged for on top of your actual cell phone service. As I mentioned earlier, you may not see every single fee and tax on your cell phone bill.

Here are some of the terms you may see on your monthly bill:

911

This charge on your cell phone bill is self-explanatory - it is collected in order to fund emergency services in your area. This fee is structured as either a set amount per line or a percentage of your bill. Are you curious how much the 911 wireless fee is in your state? Find out on the National Emergency Number Association website.

Universal service fund

Wireless carriers are required by the federal government to pay a percentage of their revenue into the Universal Service Fund. This money helps the government provide support for telecommunications services to rural and high-cost areas, as well as schools and libraries. The fee is regulated by the FCC and is adjusted as needed, depending upon the Fund's balance.

Here's the rub: while the USF fee is mandated by the government, cell phone providers are not obligated to pass that charge along to you, the customer. The vast majority do so anyway because, frankly if they can force you to pay it, why not?

State telecommunications excise surcharge

This little gem may also be noted on your bill as a Gross Receipts Tax Surcharge, Telecom Services Excise Tax, or some other combination of these terms. What is it? No one seems to be 100% sure, but Verizon puts it this way:

"Applied per line, this monthly Verizon surcharge recovers from customers the state or local tax on gross revenue paid by Verizon and may be referred to on your bill as a Gross Receipts Tax Surcharge, a Telecommunications Services Excise Tax Surcharge, or a State Transaction Privilege Tax Surcharge."

If it sounds as though Verizon Wireless is openly admitting that you're paying their state and local income taxes for them...well, I'll let you draw your own conclusions.

Regulatory charge

This sounds so official, doesn't it? Despite the legalese name, this charge is not a government-imposed tax.

Rather, regulatory charges on your wireless bill are simply a way for carriers to get you to foot yet another bill. The government requires telecommunications providers to comply with certain regulations, and this fee ensures that carriers don't have to cover their own costs of being in business.

Administrative charge

This is what AT&T has to say about their own Administrative Charge:

"The Administrative Fee helps defray certain expenses AT&T incurs, including but not limited to: (a) charges AT&T or its agents pay to interconnect with other carriers to deliver calls from AT&T customers to their customers; and (b) charges associated with cell site rents and maintenance."

Just like Verizon, AT&T seems to be transparent about where the fee is going. Here's the issue, though. At the top of the fee explanation page on the provider's website, they also state the following:

AT&T seems to be implying that their extra charges are required by local, state, and federal governments. This is most certainly not the case - there are no laws requiring cell phone providers to charge you an administrative fee.

State and local taxes

Some states charge sales tax on services. Likewise, certain counties and cities add fees or taxes to wireless bills. These taxes may sound fairly valid. After all, we pay sales tax on many things.

If you live in New York City, however, you may disagree. Residents of the Big Apple pay the MTA tax on their wireless bill, which funds the transit system. You're probably saying to yourself, "What does the Metropolitan Transit Authority have to do with my cell phone service?" Unfortunately, there's no good answer to that.

Account spending limit

If you have Sprint, you may incur a monthly ASL fee. This charge is imposed on customers in Sprint's Account Spending Limit Program, which is designed for those with a lower credit score.

When you're enrolled in this program, you're allowed to spend up to a certain dollar amount on your account. For example, if your ASL is $250 per line, you won't be able to purchase a $600 smartphone on credit.

This list is not exhaustive; in fact, it would be impossible to provide a complete listing of all cell phone bill fees, taxes, and surcharges, due to the vast number of separate state and local jurisdictions involved. The items listed above are the most common charges you might encounter.

Phone bill breakdown

When it comes to the big three providers - Verizon Wireless, AT&T, T-Mobile, and Sprint - you're probably curious about what these charges look like on your bill. Knowing exactly what to expect is particularly helpful if you're considering switching cell phone providers - you want to be prepared for which fees you might encounter.

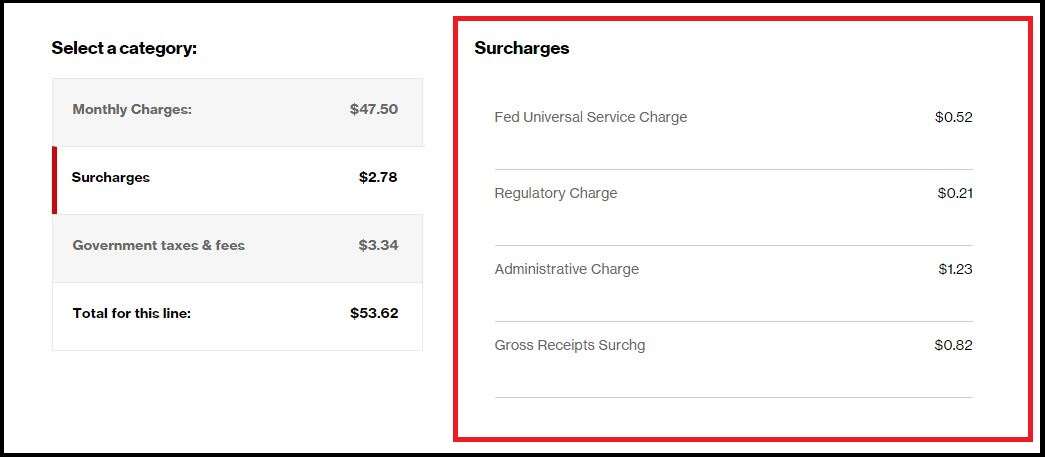

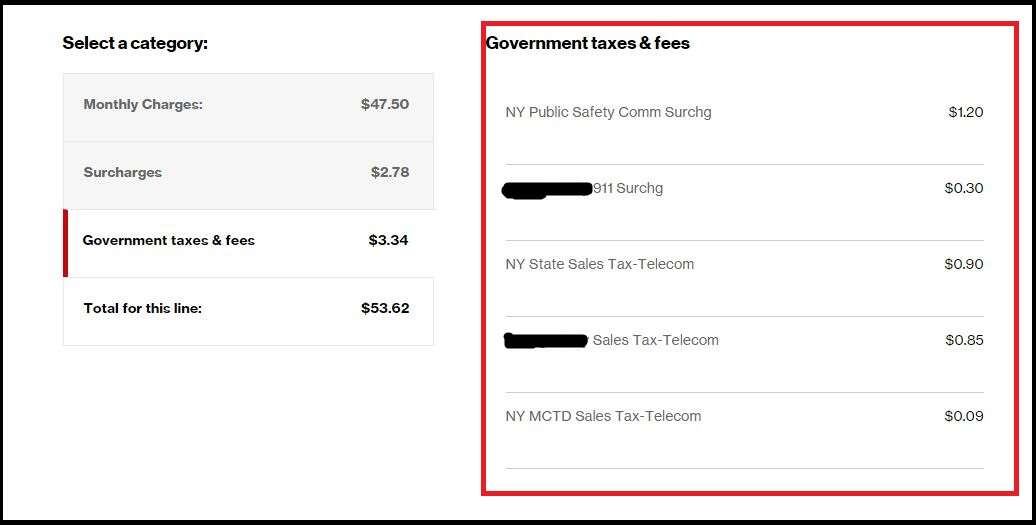

Verizon fees

Verizon charges the Universal Service Fund fee, a regulatory charge, and an administrative charge. Additionally, they provide a government tax and fees estimator tool so that you can determine exactly which charges you can expect to see based on your location.

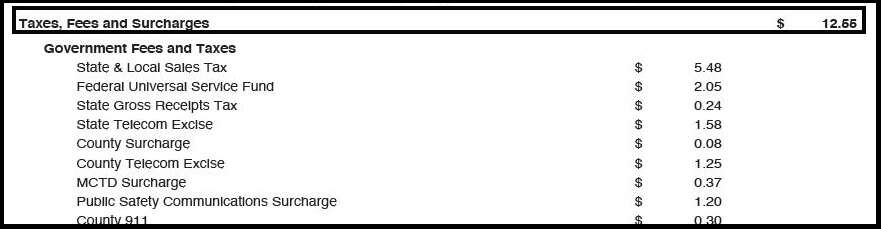

Here you can see the surcharges for this bill, which is for a plan with a single line. It may not be much month-to-month, but it adds up at the end of the year. Are you on a family plan or have multiple lines? These surcharges will be applied to each line, multiplying the total cost.

These are the government taxes and fees that will show up on your monthly bill. Again, these charges may seem insignificant, but they add up at the end of the year and increase depending on how many lines you have. For a family of four, you could be paying an additional $30 a month for just these feels alone.

Verizon also has a helpful video detailing how to understand your monthly bill.

AT&T fees

If you're an AT&T customer, you're paying the typical fees, including the USF, a regulatory charge, administrative fee, state and local taxes, and 911. One note of concern - the last item in this carrier's list of extra fees is this: "Other AT&T Surcharges." It's unclear precisely what these "other" charges are for.

T-Mobile fees

The Un-carrier does things a bit differently. T-Mobile recently announced that all taxes and fees would be included in its advertised price for the T-Mobile ONE plan. In other words, if you have four lines for $140, that's the amount due you'll see on your bill.

What's the catch? If you think there is one, you're spot on. The good news is that it's just a small one. In order to get the benefit of this all-inclusive pricing, you need to sign up for it. If you don't, you may pay some of the following charges:

- 911 Surcharge

- Regulatory Programs Fee

- Telco Recovery Fee

- Universal Service Fund Fee

- Utility User Tax

What you need to know: T-Mobile's advertised prices reflect their auto pay discount. If you opt out of autopay, you will pay $5 more per line, per month, than the advertised rate.

This is a sample bill T-Mobile offers on its site to show you what sort of government fees and taxes you might expect. T-Mobile shares what else can effect your bill.

Money saving tips

As frustrating as these extraneous charges are, there's not much you can do about them. The way the law stands at this time, wireless carriers have the right to pass these expenses along to the customer. There are, however, some things you can do to lessen the pain by lowering other parts of your cell phone bill.

Autopay/paperless billing

Enrolling in autopay is one of the easiest ways to lower your cell phone bill. Here's how much you'll save with each of the big three wireless carriers:

- Verizon: $10 per month discount for enrolling in auto-pay with a checking account or debit card (credit cards do not qualify) and paperless billing.

- AT&T: $5 per month on one line, $10 for a multi-line account, must enroll in autopay and paperless billing, must use a debit card or checking account, applies only to Unlimited Choice and Plus plans.

- T-Mobile: $5 per month per line for enrolling in auto-pay with a credit/debit card or checking account.

A note for Sprint customers: if you're on this carrier's Account Spending Limit Program, you can eliminate your $7.99 monthly fee by enrolling in autopay and eBill.

Negotiation

Don't be afraid to ask for discounts on your cell phone plan. Contact your cell phone carrier to try and negotiate a lower rate. By speaking with a representative, you might also be able to get the activation or upgrade fee waived.

If things don't go your way and you're unhappy with your cell phone service, it might be time to switch. Check out our cell phone plan comparison table to get started.

Know your bill

Examining your bill may reveal hidden cell phone fees for which you shouldn't be responsible. Go through each item with a fine-tooth comb, and if you find something that seems off, call your carrier and ask about the charge.

If they're unwilling to budge, sometimes it's enough to simply remind your provider how long you've been a customer. They're often unwilling to risk you switching mobile carriers rather than cutting out a small monthly fee.

Switching carrier

Considering all of the variables involved in cell phone fees and taxes, it can be tough to figure out the best affordable wireless service option. T-Mobile is the only carrier that offers totally inclusive, upfront pricing - what you see is what you pay.

That said, if you aren't interested in the T-Mobile ONE plan, which is the only plan the carrier offers now, you might find a better deal even when factoring in hidden wireless fees.

Ultimately, the best way to mitigate hidden cell phone fees is to find the wireless plan that fits your needs at the lowest possible price. Start by using our handy cell phone savings calculator.

Take into account the hidden fees each provider charges, which I've detailed in this guide. Knowledge is power - once you know exactly what you're paying for, you'll be able to decide on the best cell phone provider for you.